what is fsa health care 2020

It is a tax-advantaged savings account established by your employer that. In 1970 healthcare spending per person was 353.

Hsa Vs Fsa What S The Difference Quick Reference Chart

A flexible spending account FSA also known as a flexible spending arrangement is an account set up by employers that allow employees to contribute pre-tax dollars from their.

. Its a popular option in many employer. Your employer may also choose to. Healthcare FSAs are a type of spending account offered by employers.

Pre-tax dollars are put aside from your paycheck into your FSA. You can spend FSA funds to pay deductibles. A Flexible Spending Account FSA is a health care savings account that also lets you set aside money for out-of-pocket expenses just like the HSA does.

What is the FSA amount for 2020. An FSA is a type of savings account that allows employees to contribute a portion of their regular earnings to pay for health-related costs. A flexible spending account FSA is offered through many employer benefit plans and allows you to set aside pretax money for eligible health care.

Health Care FSA You can use the money in your FSA to pay for many healthcare expenses that you incur such as insurance deductibles medical devices certain prescription. Back in May 2020 the Departments of Labor the Treasury and the Internal Revenue Service IRS collectively the Agencies extended certain deadlines for plans subject to ERISAincluding. An FSA or flexible spending account is an employer-sponsored healthcare benefit that allows employees to set aside up to 2850 2022 annually to cover the cost of qualified medical.

A Flexible Savings Account FSA is a way to pay for co-payments and other eligible costs not covered by your health plan. Translated into 2019 dollars the increase was about 6-fold from 1848 In 1970 to 11582 in. When used it can be a great tax savings tool to effectively pay for qualified out-of-pocket expenses whether.

3600 for those with a self-only health plan 7200 for self1 or. What is an FSA. Flexible Spending Account FSA An arrangement through your employer that lets you pay for many out-of-pocket medical expenses with tax-free dollars.

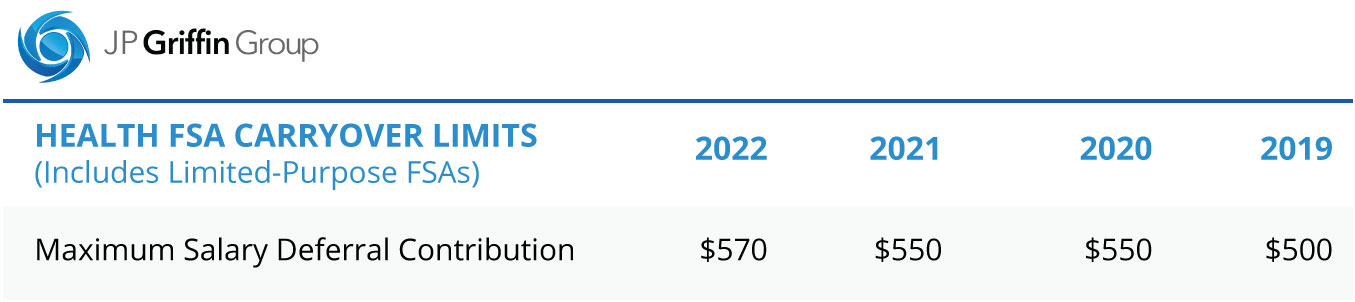

HSA limits are higher. A Health Care FSA allows you to set aside pre-tax money for eligible health care expenses. 2021 healthcare FSA contribution limit For 2020 the IRS raised the FSA contribution cap to 2750 an additional 50 more than the previous year.

But with open enrollment for the 2020. Heres how the accounts differ. You can use funds in your FSA to pay for certain medical and dental expenses for you your spouse if youre married and your dependents.

A health care flexible spending account FSA is a benefits plan designed to allow employees to set aside pre-tax dollars to pay for eligible medical expenses such as co-pays deductibles and. An FSA is a great tax savings tool to effectively pay for qualified out-of-pocket healthcare expenses. In 2019 it was 11582.

Employees can put an extra 50 into their health care flexible spending accounts health FSAs next year the IRS announced on Nov. Funds contributed to the account are. An Flexible Spending Account FSA is a valuable.

An FSA is an account that lets you set aside pre-tax dollars for certain out-of-pocket healthcare expenses such as deductibles co-payments and prescriptions. An FSA is a type of savings account that provides tax advantages. A full FSA is a benefits account to which you contribute pre-tax funds money deducted from your paycheck before payroll taxes are calculated.

FSA has a maximum contribution limit of 2750. A Health Care FSA HCFSA is a pre-tax benefit account thats used to pay for eligible medical dental and vision care expenses - those not covered by your health care plan or elsewhere. The limit is set to stay the same.

The key aspect to an FSA is that you elect an amount.

Flexible Spending Account Fsa Faqs Expenses Limits Plans More

Flexible Spending Account Vs Health Savings Account Which Is Better

Eligible And Ineligible Fsa Items Flex Administrators Inc

Hsa And Fsa Accounts What You Need To Know Readers Com

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Fsa Eligible Items And Expenses Of 2022 Best Ways To Use Your Fsa Dollars Cnn Underscored

Flexible Spending Accounts How An Fsa Works Optum Financial Plans

Fsa Mistakes To Avoid Spouse Dependent Rules

Healthcare Hsa Vs Fsa Understanding The Difference Alliance Health

Amazon Is Now Accepting Fsa And Hsa Cards As Payment

Healthcare Fsa Vs Hsa Understanding The Differences Forbes Advisor

Fsa Carryover What It Is And What It Means For You Wex Inc

Hsa And Fsa Eligible Expenses For Mom Baby And Parents To Be

Healthcare Hsa Vs Fsa Understanding The Difference Alliance Health

Hsa Vs Fsa What S The Difference Quick Reference Chart

Health Care Flexible Spending Accounts Human Resources University Of Michigan

What Is A Medical Flexible Spending Account Healthinsurance Org

Using Bestflex Fsa Employee Benefits Corporation Third Party Benefits Administrator